In a nutshell: What if unique assets could be represented, traded, and owned digitally? Non-Fungible Tokens (NFTs) enable the representation of a wide range of assets on a blockchain, from real-world ones such as the ownership of a plot of land, to digital ones, such as virtual art. These representations can then be transparently and securely traded, allowing for trusted ownership validation and the creation of new markets.

Key Features: Uniqueness | Digital Ownership | Programmable Assets | Authenticity Verification | Transparent Transactions | Market Creation

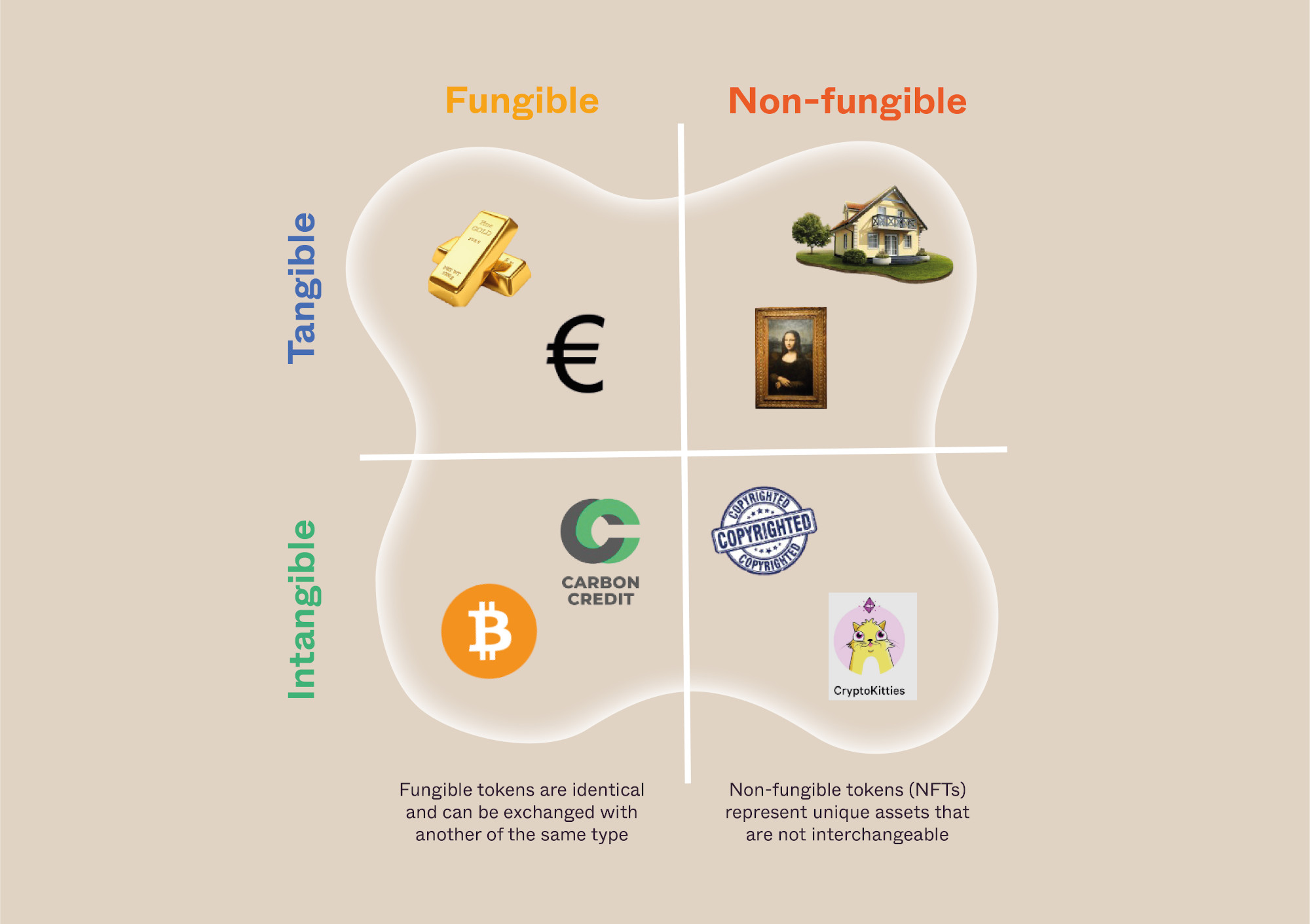

The tokens, or cryptocurrencies, described in the previous chapter are fungible, meaning that one token can be exchanged with another of the same type. For instance, a one-hundred-dollar bill can be exchanged with another, or, say, for two fifty-dollar bills, which makes it fungible. Non-fungible tokens (NFTs), on the other hand, represent unique assets that are not interchangeable, such as a piece of real estate or intellectual property, or artwork. These assets are represented on a blockchain by a unique digital identifier that cannot be copied, substituted or subdivided. Tokenizing such assets on a blockchain makes buying, selling and trading them more efficient by dismissing the need for intermediaries while increasing the transparency around ownership records and reducing the probability of fraud. Because of these qualities, NFTs are often used to certify authenticity and ownership.

Binding an NFT to a smart contract makes it programmable, unlocking new possibilities and use cases for this concept. For instance, an NFT can be programmed to pay royalties to its issuers any time ownership is transferred. This could mean, for example, that an organisation using NFTs for fundraising could secure automatic royalties down the purchase line, creating an ongoing income stream as opposed to a one-off donation.

With this concept in mind, it’s no surprise that some of the first industries to widely adopt the use of NFTs were digital art and collectables. However, as this space evolves, additional meaningful use cases emerge, emphasising that NFTs are much more than mere JPEGs. Their purposes can range from projects that develop an individual's digital identity to offering intellectual and physical property rights and more.

All in all, NFTs are vehicles to tokenize any non-fungible asset (either real-world or digital), simplify their trading, program utility models in this process, and create new markets –all in a transparent, traceable and secure way.

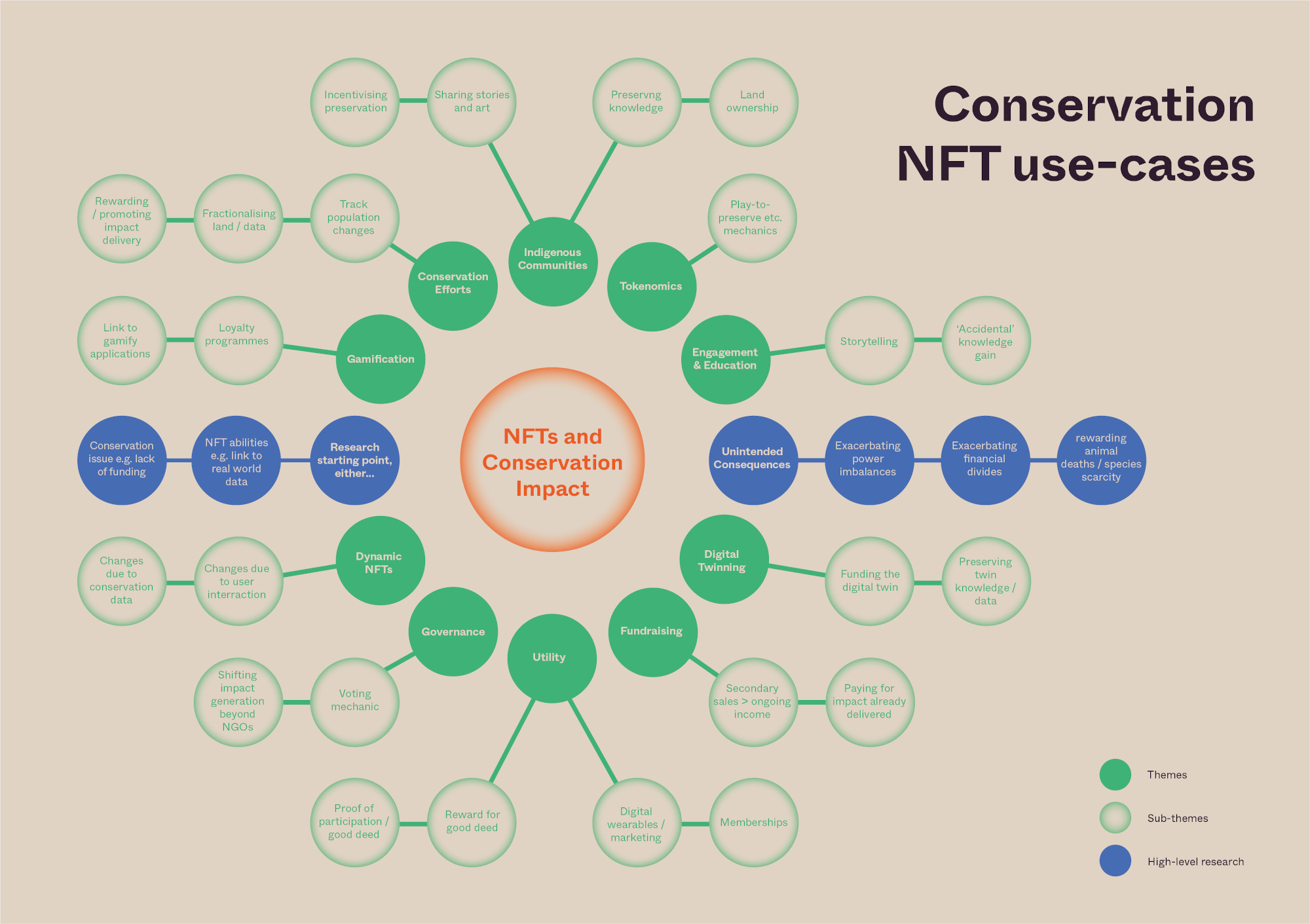

On 27 June 2022, the Luc Hoffmann Institute brought together 18 leading Web 3.0 innovators to explore how NFTs can elicit transformative change in the conservation sector. This visual depicts the themes that emerged within the NFTs for conservation impact discussions.

The following are just a few examples of what NFTs could potentially enable for nature conservation:

The fact that any real-world asset can be tokenized as an NFT (a process known as ‘digital twinning’), opens the door for the creation of new markets. For instance, rooftops could be tokenized and traded as real estate spaces to fund and incentivise the transition to solar energy. Wildlife tracking data might be tokenized and traded among researchers who need to use it for a study, or a member of the public wishing to support a scientific conservation effort. An NFT’s underlying smart contract could be programmed to stream royalties to a conservation organisation on any recurring sale of the asset. Such endless tokenization opportunities can enable new and innovative funding streams for conservation.

New developments have enabled the concept of dynamic NFTs. In contrast to static ones, dynamic NFTs living on the blockchain can be modified in reaction to a real-world event acting as a trigger or any other condition coded in their smart contract. This then unlocks new opportunities for NFTs. For instance, a dynamic NFT representing a tracked elephant population could trigger an automatic change of ownership if the elephants enter a particular area or corridor. Then, communities living in that area could automatically be compensated in various ways to maintain the area as a habitat. The same concept could likewise be used at the governmental level to allow the safe movement of wildlife populations across different national jurisdictions.

Dynamic NFTs could also be used to introduce gamification into conservation engagement. For instance, unlocking a reward for an NFT holder once a real conservation outcome has been achieved. Imagine, for example, a conservation supporter automatically rewarded with a new ‘gorilla’ NFT once an offspring is born in the wild. They can then sell the new NFT, with some of the proceeds feeding back into the conservation project.

As tokenization implies representing assets in a digital form, any real-world asset can be fractionalised into distinct NFTs representing parts of it. This attribute opens the door for decentralised ownership and the democratisation of asset acquisition. For instance, a community wishing to acquire land to restore a natural habitat could fractionalise the plot into many distinct NFT representations, thus lowering individuals’ cost of participation and simplifying trade in pieces of land. Such fractionalisation and decentralised ownership may also reinforce the long-term sustainability of a project, since it may be harder to persuade thousands of individual landowners to sell or repurpose land than it is with a single owner. In the same manner, an NFT holder can own a few solar panels in a thousand-panel solar farm, receiving the income associated with their amount of ownership. Thus, fractionalising assets using NFTs has the potential to democratise and decentralise ownership, while increasing participation in conservation initiatives.

1. Zeedz is a ‘play-for-purpose’ game where players reduce global carbon emissions by collecting plant-inspired NFTs called Zeedles. The project raises money for nonprofits, including USD$1.64 million USD in the pre-sale, and aims to raise awareness about global warming and sustainable living within their community. The game is played on a real-world map using live weather data.

2. Moss purchases portions of lands in the Amazon that are at risk of deforestation and digitally fractionalises them into 1-hectare portions, each roughly the size of a football field, and stores the rights to these portions as NFTs. The Moss Amazon NFTs are actual land sales; proceeds from the sales fund further purchases, and 20% of all revenue from the NFTs goes towards the costs of patrolling, satellite imagery and other needs for the areas’ conservation activities.

3. Souls of Nature is an NFT project consisting of 9,271 unique ‘nature souls’ NFTs. A portion of the collection's initial funding will go towards conservation efforts, and the holders of the NFTs will be able to use them within a virtual world in which they ‘nurture’ their NFT in a gamified mission to protect nature.

4. Anibles is a soon-to-be-released project aiming “to bring funding for conservation into the digital era”. The NFT collection features 60 species of digital animals combined with utility for the buyers such as royalties, and the potential of going on real-world trips. The project aims to improve education and awareness of conservation issues by featuring the Anible characters in a gaming environment where users act as rangers, and by producing storybooks for children.

5. National Parks NFT used their 4,835 strong NFT collection to act as membership cards to 63 US National Parks. They aim to create “the world’s most passionate outdoor community” and reward active users and park visitors with points that can be spent on real-world items, such as hiking or photography gear.

Interested in using NFTs? Here are some points to consider.